What Is the Intrinsic Value of an Asset? Definition, Formula, and Example

MediaIn finance and valuation theory, the intrinsic value of an asset is defined as the price a rational investor is willing to pay for the asset, given the level of risk the investment has.

Read on to learn all about it!

What is the Intrinsic Value of an Asset?

In finance, business valuation, and investment analysis, the intrinsic value of an asset (also known as its true value or fair value) represents the price a rational investor is willing to pay for it today, based on its future cash flows and risk level.

In simple terms, the intrinsic value equals the net present value (NPV) of all expected future cash flows, discounted using a rate that reflects the investment’s risk profile. One of the most popular valuation methods used to determine intrinsic value is the Discounted Cash Flow method (DCF).

How to Calculate Intrinsic Value (Step-by-Step)

To calculate the intrinsic value of an asset, analysts and investors follow these three essential steps:

-

Estimate Future Cash Flows

Begin by forecasting the future cash flows the company or asset is expected to generate. Use the current cash flow as a base, then estimate growth based on the company’s stage in the business life cycle — whether it's in a growth stage, maturity phase, or decline. -

Determine the Discount Rate (WACC)

The discount rate represents the required return for the investment, adjusted for risk. It’s commonly calculated using the Weighted Average Cost of Capital (WACC) formula, blending the cost of equity and cost of debt. -

Compute the Intrinsic Value

Discount the projected cash flows from Step 1 using the rate from Step 2. The sum of all discounted cash flows equals the intrinsic value of the asset.

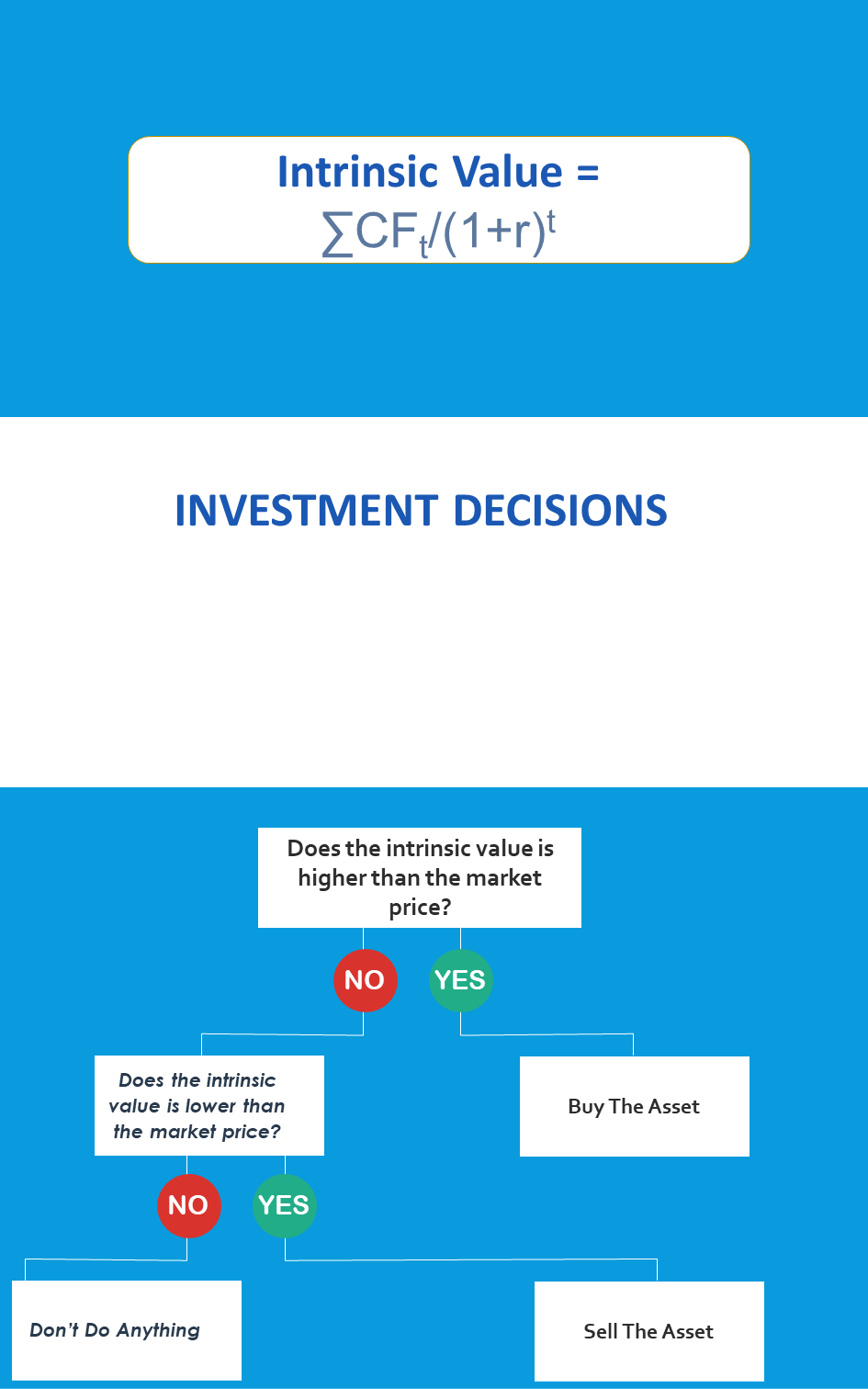

The Formula for the Intrinsic Value

The general formula for intrinsic value is:

∑CFt/(1+r)t

Where:

CFt is the cash flow an asset is expected to yield in year t

r is the discount rate

Example of Calculating the Intrinsic Value

Suppose a company will yield two expected cash flows - 10 dollars at the end of the first year and 20 dollars at the end of the second year. Given a discount rate of 15%, the intrinsic value equals 23.82 dollars:

(10/1.15 + 20/1.152).

The use of the intrinsic value

The intrinsic value is used for investment decisions. An investor can compare the asset price in the market, such as the share price in the capital market, with the intrinsic value.

If the intrinsic value is higher than the price of the property in the market, the investor should purchase the property, expecting that the price of the asset in the market will rise, and he will profit.

If the asset's intrinsic value is lower than the market price, the investor should sell the asset with the expectation that its price will drop.

Why Intrinsic Value Matters to Investors

The concept of intrinsic value is central to investment strategy, asset valuation, and equity research. It helps investors identify whether an asset is overvalued or undervalued relative to its market price:

-

If the intrinsic value > market value, the asset is likely undervalued → a buy opportunity.

-

If the intrinsic value < market value, the asset may be overvalued → consider selling or avoiding.

Key Takeaways

-

Intrinsic value reflects the asset’s true worth based on fundamentals, not market speculation.

-

It relies on expected cash flows, risk, and discount rates.

-

The DCF method is the most widely used model to estimate intrinsic value.

-

Comparing intrinsic value vs. market value helps investors make smarter, data-driven decisions.

In short:

Understanding the intrinsic value of an asset allows investors to make informed investment decisions, identify undervalued opportunities, and reduce the impact of market volatility.

(See infographic: The Intrinsic Value of an Asset)